BCGE Twint application: Mobile payment made easy for all our clients

The BCGE Twint application enables you to rapidly and easily send, request and receive money directly from your BCGE account, using your telephone. BCGE Twint also enables you to pay participating retailers.

The BCGE Twint application is compatible with the following mobile phones

| Operating System | Manufacturer / Device |

|---|---|

|

Apple iOS 12.2 (or higher)

|

Apple iPhone (starting from iPhone 5s)

|

|

Android 7 (or higher)

|

HTC, Samsung, LG, Sony Xperia etc...

|

BCGE Twint conditions

- Hold a BCGE Privé account

- Hold a BCGE Netbanking access

- Have a smartphone or a tablet with a Swiss telephone number and to be connected to a Swiss store

Activate BCGE Twint

- To guide you during your first connection, find our registration support here

- To retrieve your access to BCGE Twint, find our re-registration support here

Using the App

With the BCGE Twint application it is so easy to pay what you owe in participating shops, restaurants or vending machines.

1. Pay for your purchases easily with your smartphone

- Activate Bluetooth and open the BCGE Twint app

- Select “Pay at the Beacon” in the menu

- Hold your smartphone up to the Beacon (glowing Twint logo)

- It's paid

You can also use BCGE Twint to pay at cash registers without a Beacon

- Open the BCGE Twint app

- Select “Pay with code” in the menu

- Point your smartphone’s camera at the QR code being displayed

- It's paid

2. Pay for online purchases

No need to enter your bank card number for every online payment. With BCGE Twint, you can make quick payments with your smartphone.

- Open the BCGE Twint app

- Scan the QR code on the screen

- Confirm the payment

- It's paid

3. Pay at some vending machines

- Open the BCGE Twint app

- Point your smartphone’s camera at the QR code displayed on the machine

- Select the desired product on the vending machine

- It's paid

Some vending machines are also fitted with a Twint Beacon: hold your smartphone briefly up to the glowing Twint logo or follow the instructions on the vending machine.

The BCGE Twint application enables you to send or receive money very easily and in total security.

In many cases, Twint is the most practical solution to:

- deposit your children's pocket money on their account

- send some money to your sister for granny's birthday present

- receive the money you lent to someone last week-end

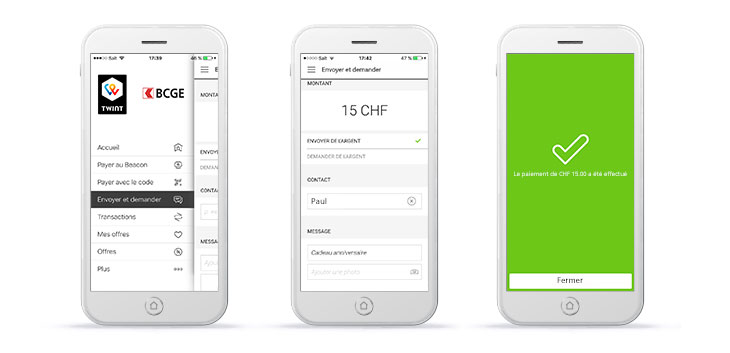

Send money

- Log on to BCGE Twint

- Click on «Send»

- Enter the amount you wish to send

- Choose the beneficiary from your list of contacts

- You can also attach an image and a message

- Press «Send» to confirm

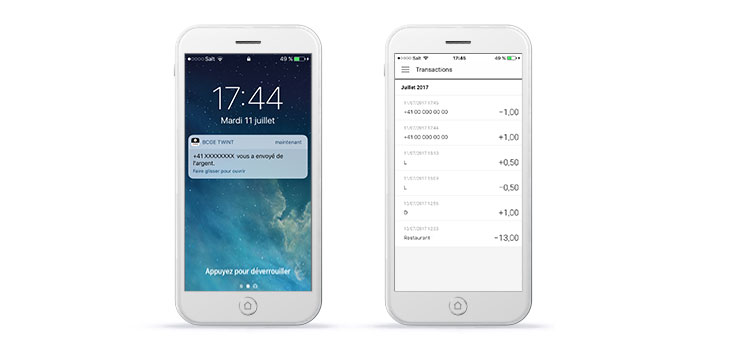

Receive money

- Receive a notification on your smartphone

- In «Statement entries», view the history of amounts sent or received

- Click to access the detail of the payment

The BCGE Twint application enables you to request some money directly from one or more of your contacts.

- Log on to BCGE Twint

- Click on «Request»

- Enter the amount you wish to request

- Choose the recipient in your contacts

- You can also attach an image and a message

- Press «Request» to confirm

With the BCGE Twint application, offer your clients a modern and fast means of payment.

In order to meet the needs of each retailer, BCGE Twint offers different cashless payment solutions.

1. Cash register with terminal

Upon collecting their payments, your clients will be shown a QR code which they scan with their smartphone. The solution is also available for mobile terminals.

2. Cash register with beacon

The device establishes the connection between your cash register and the client's smartphone. This solution can be used offline - it is thus also possible to collect payments using the Beacon if your clients do not have any mobile reception.

3. Online shop

With BCGE Twint, your clients can make payments in your online shop quickly and easily. Upon checking out, a QR code is displayed which they scan to make the payment.

BCGE Twint has many advantages for both retailers and clients. Clients can pay with their smartphone without the need for additional infrastructure. For the retailer, the procedure to follow at the payment terminal is exactly the same as for a card payment. This means less cash to handle and greater security for the company and its employees.

More information on the TWINT website.

FAQ

BCGE Twint is an app which allows money to be transferred from one Twint user to another. The Twint solution is already offered by several establishments. Money can be sent and received between the different Twint apps.

BCGE Twint simplifies money transfer at any time. The transfer is instant and straightforward. Your loyalty cards can also be incorporated into your BCGE Twint account, giving you the benefit of a real digital wallet.

Yes. No charge is made for the app and for using it.

You can pay in shops equipped with a beacon without an Internet connection. The other functions are not available offline.

To register with Twint and connect your BCGE account, you must download the BCGE Twint app and follow the registration steps. You also need access to BCGE Netbanking and a BCGE Privé account.

You can be registered with more than one Twint app, but you can only use the app with which you registered last.

To activate your BCGE Twint account, you will receive an e-document in your Netbanking very soon or a letter within days of your registration. You will then need to scan the QR code on this letter to finalise activation of your BCGE Twint account.

Activating your BCGE Twint account enables you to use the app with higher payment limits.

Yes. To register and for security reasons, you must enter your BCGE Netbanking contract number in the app.

You can use BCGE Twint from a BCGE Privé 12-25 or BCGE Privé account.

After registering your account on the application, you may not send more than CHF 50 per day and a total of CHF 200. You then have 5 days to finalise the registration of your BCGE Twint account thanks to the letter received at home or in the E-documents in your Online Solutions. The monthly limit is then extended to CHF 4'000 for payments between two persons and to CHF 5'000 for payments in shops.

If you have forgotten your PIN code, please contact the online banking hotline at 058 211 21 00 (Monday to Friday from 7.30am to 7.30pm, Saturday from 9am to 4pm and Sunday from 9am to 1pm.).

If your smartphone is stolen or lost, please call the online banking hotline to place a stop on your Twint account. However, use of the smartphone should not be possible without the PIN code previously set by you.

If you change your phone, please download the app again and provide the information requested. You will be able to restore your BCGE Twint account easily.

Please inform the bank if your telephone number has changed. On request, access to your old number can be closed. You can contact the online banking hotline at 058 211 21 00 (Monday to Friday from 7.30am to 7.30pm, Saturday from 9am to 4pm and Sunday from 9am to 1pm.).

The terms and conditions of use for BCGE Twint can be consulted on https://www.bcge.ch/twint-utilisation, on Apple Store and Google Play, and in the BCGE Twint app during the registration phase.