Vested benefits custody account

The vested benefits custody account allows you to invest all or part of your pension fund assets (2nd pillar) in Synchrony LPP funds.

Custody account maintenance free of charge

Capitalising on market opportunities

Choosing an investment strategy based on the risk profile

Investment that strictly complies with the legal framework for pension plans (OPP 2)

The essentials

An additional investment tool

The vested benefits custody account allows you to invest all or part of your pension fund assets (2nd pillar) in Synchrony LPP funds.

Synchrony LPP investment fund

The objectives of multi-manager Synchrony LPP Funds are to facilitate the most regular possible growth of your pension capital, while limiting risks through optimal diversification of investments according to profiles. They are managed by professionals who monitor, day after day, the performance of the investments made and the evolution of the financial markets. However, it is not possible to invest your vested benefit assets in the Synchrony LPP 80 fund.

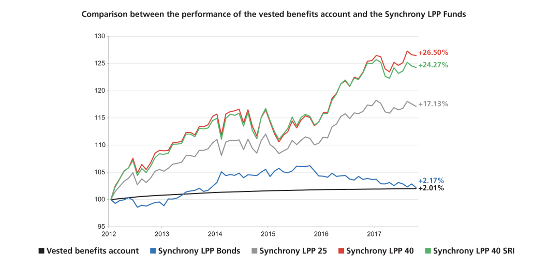

Comparison of performances since 2013

This graph is provided for information purposes only. The information does not constitute an invitation or an offer to buy or sell securities or financial instruments. Past performance is no guarantee of future returns. Prior to any investment decision, investors must ensure that they are not violating the requirements applicable within their jurisdiction and must be familiar with the documents specific to the products concerned.

Further information

The vested benefits custody account is intended for persons with an investment time horizon of at least three years. As soon as the AVS retirement age is reached, Synchrony LPP funds can be held in an independent management custody account.

Taxation

For as long as your pension assets are in the 2nd pillar, they are not subject to wealth tax. When you withdraw, your capital will be taxed at a reduced rate.

Withdrawal

Withdrawal may only take place at the earliest five years before the legal AVS retirement age. Early withdrawal is only possible under certain conditions:

- Financing / amortisation of a primary housing loan (possible every five years)

- Definitive departure from Switzerland (restrictions apply to EU countries, Iceland, Liechtenstein and Norway)

- Starting a self-employed activity

- Your vested benefit assets represent less than your annual contribution to the occupational pension

- You receive a full disability pension (70% minimum)

A question?

Contact us