Online Trading 1816

The 1816 trading platform is an interesting way to invest your company's surplus liquidity independently on the stock exchange. Integrated into Netbanking and BCGE Mobile Netbanking, 1816 is simple, practical and competitive.

The essentials

Online management of your securities

The 1816 platform allows you, as an entrepreneur and experienced investor, to manage your securities independently in a few clicks. 1816 is integrated into the Netbanking and BCGE Mobile Netbanking platforms. Thanks to its continuous availability and ease of use, you can buy and sell your securities directly on the financial markets in complete autonomy.

With the 1816 online trading solution, your company has access to the Swiss, European, American and Australian stock exchanges, as well as the Tokyo and Singapore stock exchanges.

In-depth and detailed financial information

With the 1816 platform, your company has direct access to yourmoney.ch, which provides up-to-date financial information on securities and markets. As a BCGE corporate client, you can create your own account and access the lists of tracked securities, portfolio simulations or the creation of alerts.

The most competitive rates

Subscribing to the 1816 online trading platform is free of charge. The brokerage fees applied to transactions are among the most competitive on the market.

Brokerage fees

- None for BCGE shares, Synchrony fund units and Tracker Certificates managed by BCGE

- Orders on Swiss market: from CHF 4

- Orders on Europe and North American markets: from CHF 10

- Asian and Oceania markets: from CHF 25

Consult Fees and Conditions for more information

Reduced custody fees

- No custody fees for BCGE shares

- Synchrony funds and Tracker Certificates managed by BCGE: 0.10% of assets under management + VAT (maximum CHF 50/quarter + VAT)

- Otherwise: 0.10% of assets under management + VAT (minimum CHF 15/quarter + VAT, maximum CHF 50/quarter + VAT)

Comply with the security guidelines

Using internet and online banking facilities remains safe as long as a number of elementary security rules are respected. To use 1816, as for any other internet platform, it is necessary to apply them with consistency and discipline.

There are inherent risks in managing a portfolio online associated with financial market fluctuations. We recommend that you discuss the subject with your personal adviser. He can guide you towards a balanced distribution of your securities, in the form of a management mandate or an investment fund, for example.

FAQ

What type of limit should I choose when placing an order?

The online trading 1816 platform allows the user to define different order types, with or without limits. An explanation on how they work is provided below.

Buy orders

A buy limit order is used when the user decides on a maximum price that he does not wish to exceed to buy a security, over a defined period of time.

For example, the investor decides to buy at a maximum price of CHF 102. The order is placed for a given time and will only be executed if the security price is equal to or below CHF 102.

A buy stop-loss-order only triggers an order when the security has reached a certain price.

For example, a person only wants to buy a security if the price reaches CHF 102. He hopes to detect a trend, he thinks that the price of the security will rise and therefore wishes to buy it as from this price which will trigger a market order.

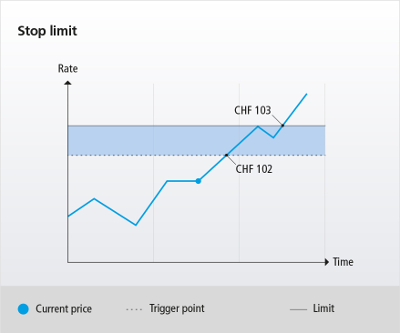

By selecting the stop limit feature, the order will be triggered if the price of the security reaches a defined threshold, while setting a maximum price that the investor does not wish to exceed.

For example, the 1816 platform user only wants to buy if the security reaches CHF 102 but not if it exceeds CHF 103. Once the order is triggered, it appears in the market as an order with a limit at CHF 103.

Sell orders

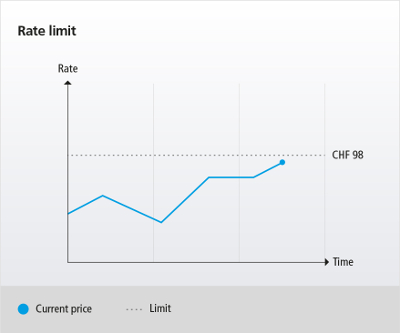

A sell limit order is used when the user decides on a minimum price that he does not wish to exceed to sell a security, over a defined period of time.

For example, the platform user decides not to sell for less than CHF 98. The order is placed for a given time and will only be executed if the share price exceeds CHF 98.

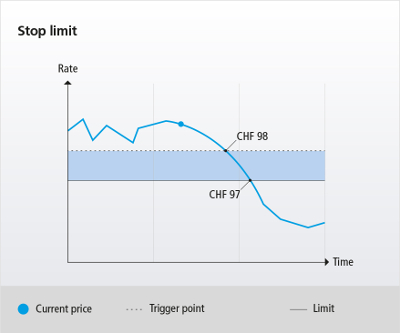

For example, a person only wants to sell if the security falls to CHF 98 or less. He thinks that it will fall again and wishes to sell before incurring greater losses. From CHF 98, a market order is triggered.

For example, the investor wishes to sell only if the security falls to CHF 98 but not below CHF 97. Once the order is triggered, it appears in the market as an order with a limit at CHF 97.

News

Invest online to optimise your surplus cash

A securities portfolio is an option worth considering if your company is looking to manage its surplus cash. This secure, simple and cost-effective to...

Discover