Fixed-rate mortgage

A fixed-rate mortgage guarantees the stability of your property loan by covering you against rises in market rates. This property loan enables you to acquire a property and benefit from the same rate throughout the whole mortgage period.

An interest rate and a loan period which are determined up-front

Stable interest charges, enabling you to plan your budget confidently

The essentials

Discover a stable property loan

A fixed rate is advantageous if the general level of interest rates is low or if you fear that there might be a general rise in market rates. A fixed-rate mortgage provides you with stability for your property budget by protecting you against market rate rises.

A loan for all projects

In the case of a renewal or of a mortgage being taken on from the competition, the BCGE lends up to 80% of the value of the property (calculated on the value of the collateral estimated by the bank). The whole of the mortgage is set up on the basis of one single rate.

Further information

Minimum amount

CHF 100,000

Term of the fixed rate contract

2 to 15 years

Rates

Fixed (set for the term of the contract). For current rates, please ask your adviser.

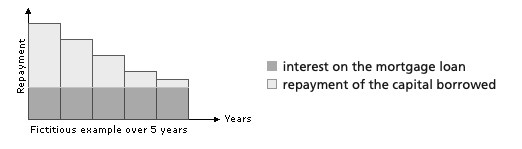

Repayment

The annual charge resulting from granting a mortgage loan comprises:

- interest on the loan

- repayment of the capital borrowed

You can also consult

A question?

Contact us