CrontoSign

An efficient technological tool.

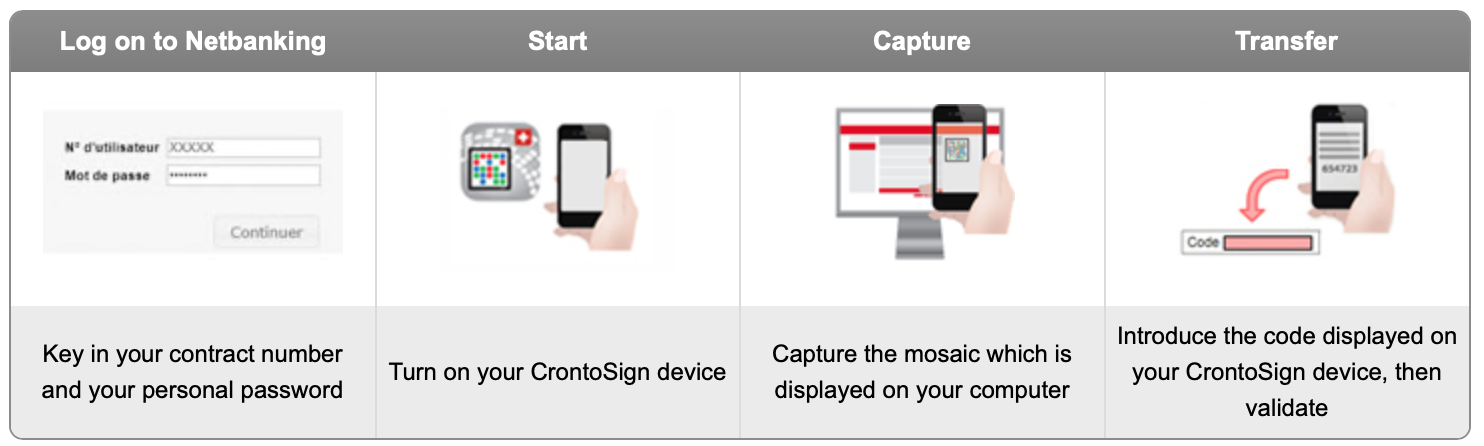

How does CrontoSign work?

The use of CrontoSign is based on mosaic scanning. The application instantly generates a code which, once it is keyed into Netbanking, validates the authentication or the payment. This new process enables log-in data and orders to be encrypted in a coloured mosaic which cannot be falsified. The data contained in the mosaic and the associated validation code are decrypted using the CrontoSign application or reader and is displayed on the screen.

The mosaic generated is unique to each operation and to each user.

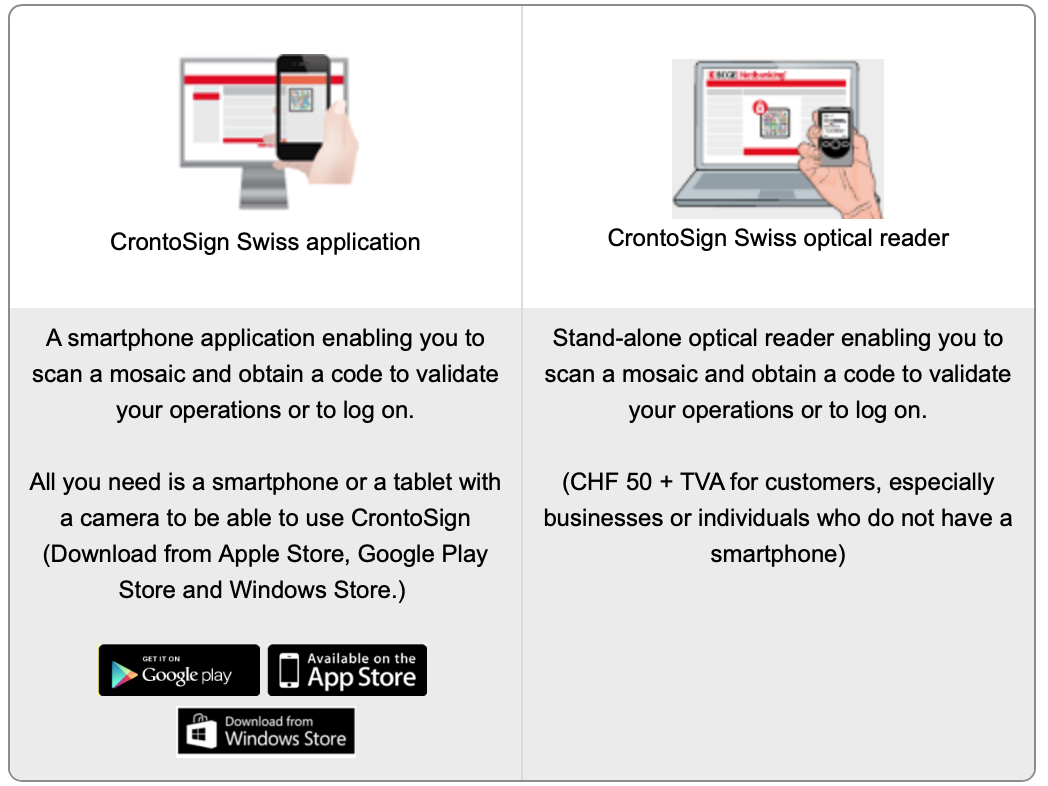

The 2 CrontoSign devices

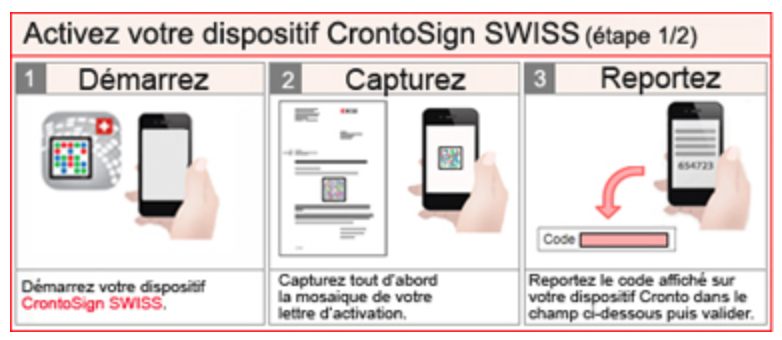

How to obtain CrontoSign ?

Contact our online bank, Monday to Friday from 7.30am to 7.30pm, Saturday from 9am to 4pm and Sunday from 9am to 1pm on 058 211 21 00. Once you have received your activation letter, simply follow the guidelines on your Netbanking screen.

Is it necessary to sign all Netbanking payments?

Only transactions in favour of certain beneficiaries need to be confirmed with a payment signature. Most regular payments and payments you have made so far do not require a signature.

This makes Netbanking as easy and user-friendly as ever, while guaranteeing you a high level of security.

How does the payment signature improve transactions in Netbanking?

The payment signature counteracts various types of attacks on the Internet, such as session hijacking and man-in-the-middle attacks. If a fraudster were to infect your computer to make a fraudulent payment, he would need a code to confirm the payment. This extra step makes it more difficult for fraud attempts.

Should you also be careful with your mobile phone?

Of course, just as with your computer, a hacker may try to infect any electronic device. You should therefore also think about the security of your mobile phone.

Do I still need to secure my PC in the future if I have the payment signature?

This is a must if you use your computer to make financial transactions (e-banking, credit card payments, transfer of confidential information, etc.): threats on the Internet are on the increase and it is essential to have good Internet protection software nowadays.

We recommend that you visit our Security web pages for information on the security of your Internet and e-banking platform connections.