Capital goods leasing: a strategic asset for supporting business dynamics

Leasing is an excellent alternative to taking out credit and an ideal solution for companies seeking to optimise or accelerate their activities. It also enables companies to preserve liquidity.

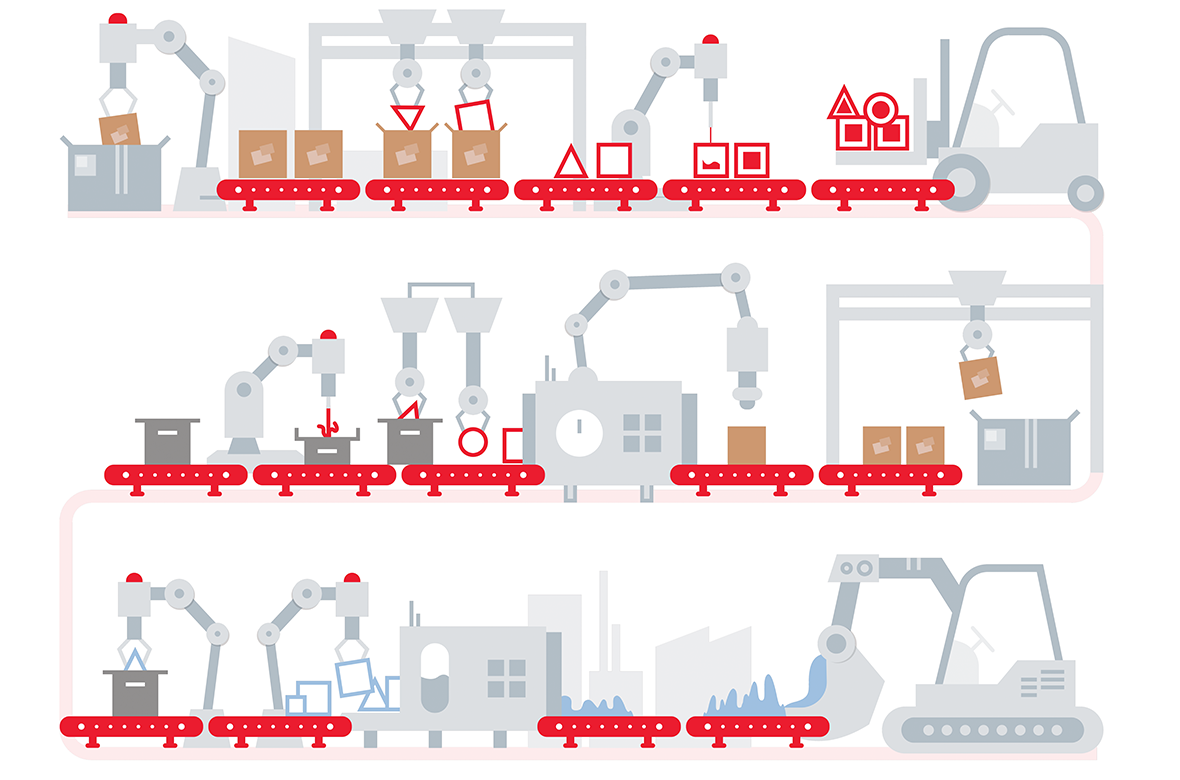

Renew your equipment and modernise your production

Leasing is an additional financing option that BCGE offers businesses and that is particularly advantageous fos companies, self-employed individuals and freelancers. The fixed-term leasing contract, with a purchase option on expiry, allows you to finance most of the equipment you need to run your business, such as production machines, utility vehicles, hoists, cranes, medical equipment and IT and telecom systems, by means of monthly instalments.

How does leasing work?

The essential feature of this type of contract is that the bank buys the object and thus acquires full ownership of it. The bank then transfers the exclusive right to use the object to the lessee, who pays a fee. A leasing contract provides for a monthly payment, similar to a rental, based on the price of the asset that is to be financed, its residual value and the duration of the contract. It is available from CHF 5,000 for a duration of 6 to 84 months, and is intended for any company seeking to replace its equipment on a regular basis or support business growth, regardless of sector.

Increase the financial flexibility of your company

Leasing capital goods comes with numerous advantages. It enables a company to preserve liquidity thanks to a low initial investment and exemption from paying VAT when taking over the equipment.

Leasing also allows for greater financial flexibility through the option to increase the initial investment and to record off-balance sheet leasing commitments. Since the monthly instalments are calculated in advance and remain unchanged throughout the duration of the contract, this solution allows you to anticipate the costs related to the investment over the contract’s entire duration.

Companies that frequently use this type of financing can obtain a BCGE credit line, which they may use as required for the purchase of capital goods, without having to submit an application for each acquisition. Managers can make more efficient investment decisions by taking advantage of this procedure and by filling out an application online in just a few clicks.

In short, thanks to the availability of competitive production equipment at all times, a company’s cash flow can be preserved and its future secured.